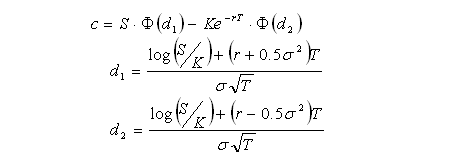

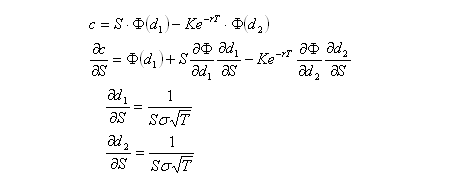

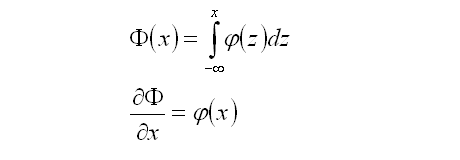

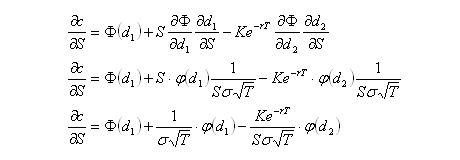

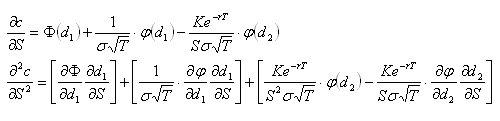

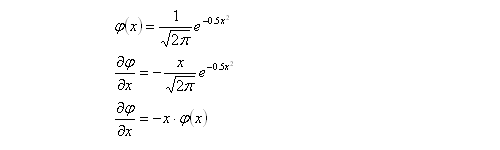

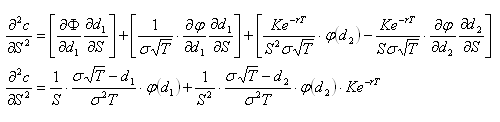

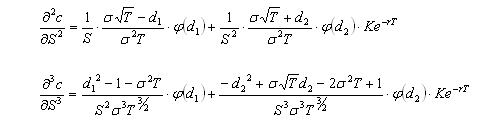

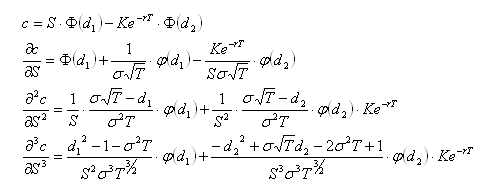

Some knowledge of options and delta hedging is required. This post is intended to demonstrate various concepts that will be used in a future post. All price-derivatives of the value of a call option have been derived previously

here.

The objective of hedging is to maintain the value of a portfolio in an uncertain market. In hedging against changes in asset prices, a portfolio consisting of options and underlying asset is arranged so that if the value of the asset decreases, the value of the options will increase. The result is a portfolio value that will change by a small amount if the underlying asset price changed.

In today’s analysis, portfolios are created consisting of:

-long positions in the underlying asset, and

-short positions in call options.

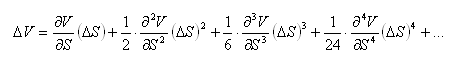

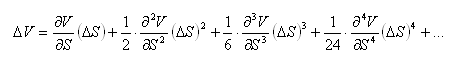

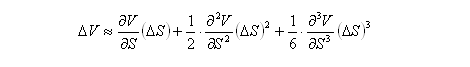

The change in value of a portfolio due to a change in the asset price can be expressed as follows:

This equation has infinitely many terms, but an approximation can be made by retaining only as many terms as desired. Because the objective of hedging is to maintain the portfolio value constant regardless of any change in S, the following condition needs to be satisfied for all values of i:

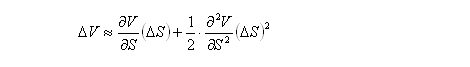

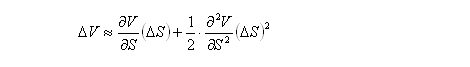

In delta hedging, only the first term is retained for accuracy to the first-order:

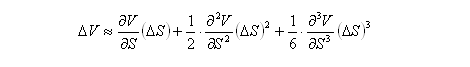

In delta-gamma hedging, the first two terms are retained for second-order accuracy:

For third-order accuracy,

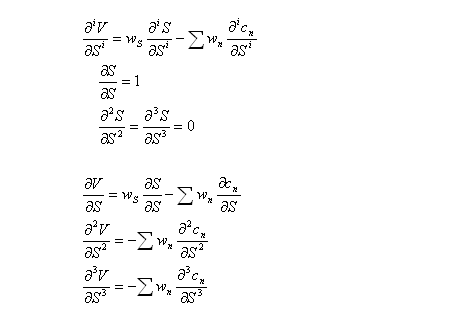

A portfolio consisting of long positions in the underlying asset and short positions in call options would have the following value:

where w corresponds to the quantity of each asset type in the portfolio.

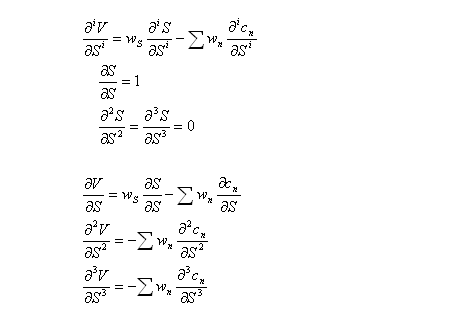

Similarly, the first, second and third derivatives of portfolio value with respect to asset price are:

Delta hedging

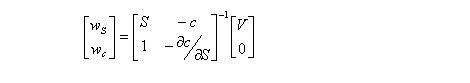

Delta hedgingFor delta hedging, only one kind of call option is required to hedge the portfolio. The value of the portfolio is to be V, and the weighted sum of first derivatives is to be zero:

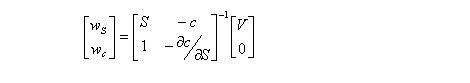

Thus, the number of stocks and options to be purchased is the solution to the following matrix equation:

Delta-gamma hedging

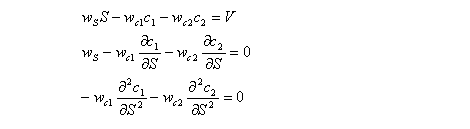

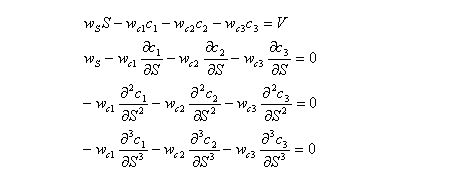

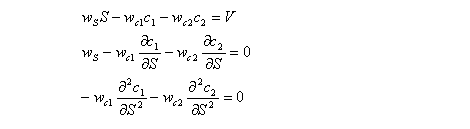

Delta-gamma hedgingFor delta-gamma hedging, two kinds of call option are required to hedge the portfolio. The value of the portfolio is to be V, and the weighted sums of first and second derivatives are to be zero:

Thus, the number of stocks and options to be purchased is the solution to the following matrix equation:

Third-order hedging

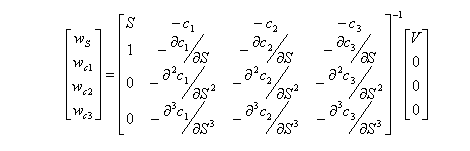

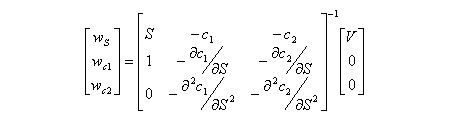

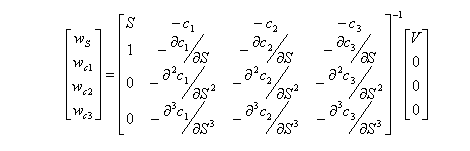

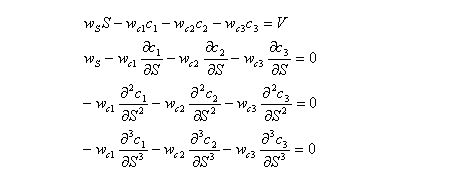

Third-order hedgingFor hedging to the third order, three kinds of call option are required to hedge the portfolio. The value of the portfolio is to be V, and the weighted sums of first, second and third derivatives are to be zero:

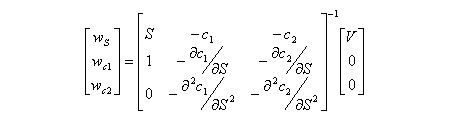

Thus, the number of stocks and options to be purchased is the solution to the following matrix equation: