Correlations between the, MYR, AUD, USD and EUR - a qualitative assessment

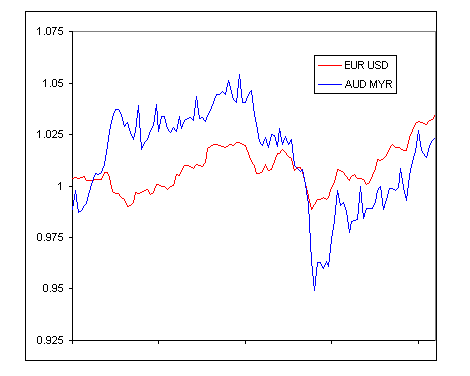

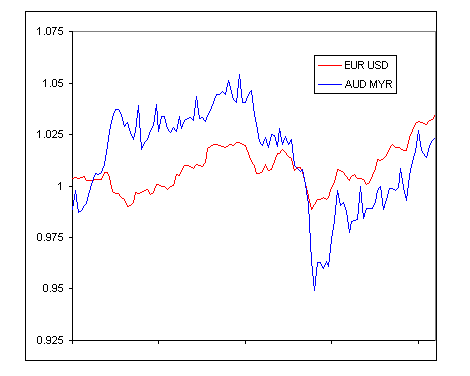

Of late, the US Dollar (USD) has been falling against the Euro (EUR). In the past days, the USD has broken all-time-low records against the Euro several times. Interestingly, the Australian Dollar (AUD) strengthened markedly with respect to the Malaysian Ringgit (MYR) over this period of time.

The Euro strengthens against the US Dollar, while the Australian Dollar strengthens against the Malaysian Ringgit

This observation suggests that it is plausible that the value of the AUD is closely connected to the EUR, and the value of the MYR is closely connected to the USD. If this is indeed the case, then the fall of the USD against the EUR will be partially mirrored by the MYR decreasing in value against the AUD.

To investigate this, the MYR will be compared with the USD and EUR to find which currency is more closely connected to the MYR, and the AUD will also be compared to the USD and EUR.

Data presentation

Average daily exchange rate data from the past 5 years are used. All data are normalised by dividing the daily exchange rate by the average exchange rate of the previous 100 days. The normalisation operation (dividing by an average) will bring all values close to 1, so that different exchange rates can be compared easily on the same scale. Effectively, the normalisation process highlights the percentage change in exchange rate.

The selection of 100 day moving average is mostly arbitrary, but the reasoning is so that gradual trends occurring over time scales of 3 months or more are not shown, but changes occurring at smaller timescales are shown.

Data comparison approach

To find the correlation of the MYR against the USD and EUR, normalised exchange rates between all three currencies will be plotted on the same graph.

In the limiting case, where the MYR is exactly correlated to the USD, the USD-EUR rate will be correlated to the MYR-EUR rate. In this limiting case, the normalised MYR is identical to the normalised USD, thus the normalised MYR-EUR and normalised USD-EUR exchange rates are identical.

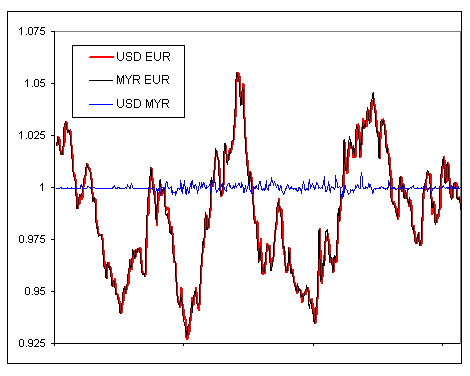

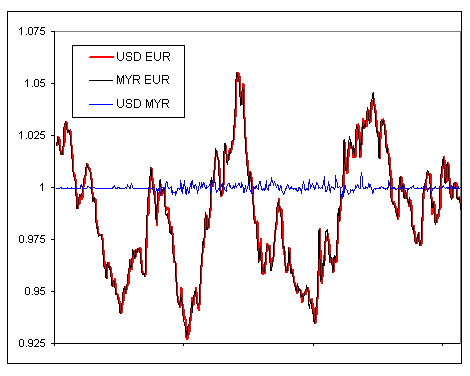

In the past, the MYR was pegged to the USD at a fixed rate of MYR 3.8 = USD 1. This represents the limiting scenario described above. The figure below shows a comparison of exchange rates between September 2003 and September 2005, and the USD-EUR exchange rate is exactly the same as the MYR-EUR rate in that period.

Echange rates between the Malaysian Ringgit, Euro and US Dollar for the period between Sept 2003 to Sept 2005.

In summary, if the MYR is closely correlated to the USD, then MYR-EUR and USD-EUR exchange rates are closely correlated because there is little difference between MYR and USD.

Data analysis - MYR

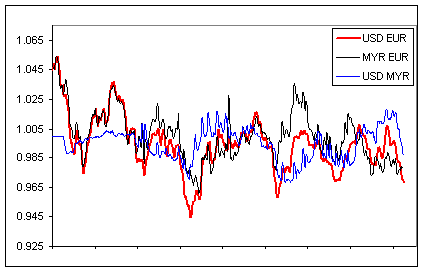

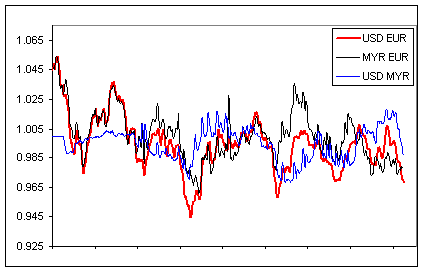

The following graph shows the MYR, EUR and USD exchange rates for the past 830 days (an arbitrary choice). The exchange rates have been chosen so that the USD-EUR forms the basis of comparison. If the MYR is closely related to the USD, then the MYR-EUR rates should resemble the USD-EUR rates.

On the other hand, if the MYR is closely related to the EUR, then the USD-MYR rates should resemble the USD-EUR rates.

Click here for large size image

Exchange rates between the Malaysian Ringgit, Euro and US Dollar for the period between July 2005 to Sept 2007

In the earlier half of the period graphed, the USD-EUR and MYR-EUR rates are very similar, suggesting that the USD and MYR are still strongly correlated. Closer to the present, near the end of the graphed period, the correlation is less obvious. However, the MYR is still closer to the USD than to the EUR.

Data analysis - AUD

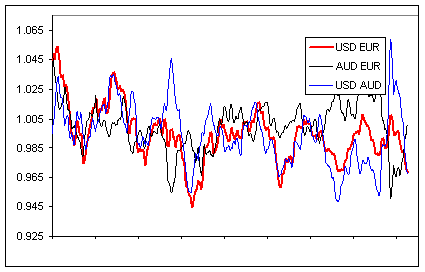

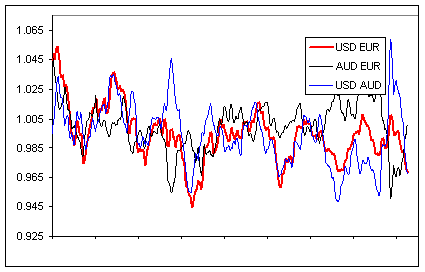

The following graph shows the AUD, EUR and USD exchange rates for the past 830 days (an arbitrary choice). The exchange rates have been chosen so that the USD-EUR forms the basis of comparison. If the AUD is closely related to the USD, then the AUD-EUR rates should resemble the USD-EUR rates.

On the other hand, if the AUD is closely related to the EUR, then the USD-AUD rates should resemble the USD-EUR rates.

Click here for large size image

Exchange rates between the Australian Dollar, Euro and US Dollar for the period between July 2005 to Sept 2007

From the 830 days graphed here, the AUD follows the EUR in a fairly consistent manner. Thus the AUD is much closely correlated to the EUR than to the USD.

Concluding remarks

From the analysis done above, it is shown qualitatively that the MYR is closely correlated to the USD, and that the AUD is closely correlated to the EUR. A change of the USD-EUR exchange rate will be reflected in a similar change in the MYR-AUD exchange rate.

Additional information

Exchange rates

5-year data for normalised rates used in this analysis can viewed for:

MYR, EUR, USD

AUD, EUR, USD

The Euro strengthens against the US Dollar, while the Australian Dollar strengthens against the Malaysian Ringgit

This observation suggests that it is plausible that the value of the AUD is closely connected to the EUR, and the value of the MYR is closely connected to the USD. If this is indeed the case, then the fall of the USD against the EUR will be partially mirrored by the MYR decreasing in value against the AUD.

To investigate this, the MYR will be compared with the USD and EUR to find which currency is more closely connected to the MYR, and the AUD will also be compared to the USD and EUR.

Data presentation

Average daily exchange rate data from the past 5 years are used. All data are normalised by dividing the daily exchange rate by the average exchange rate of the previous 100 days. The normalisation operation (dividing by an average) will bring all values close to 1, so that different exchange rates can be compared easily on the same scale. Effectively, the normalisation process highlights the percentage change in exchange rate.

The selection of 100 day moving average is mostly arbitrary, but the reasoning is so that gradual trends occurring over time scales of 3 months or more are not shown, but changes occurring at smaller timescales are shown.

Data comparison approach

To find the correlation of the MYR against the USD and EUR, normalised exchange rates between all three currencies will be plotted on the same graph.

In the limiting case, where the MYR is exactly correlated to the USD, the USD-EUR rate will be correlated to the MYR-EUR rate. In this limiting case, the normalised MYR is identical to the normalised USD, thus the normalised MYR-EUR and normalised USD-EUR exchange rates are identical.

In the past, the MYR was pegged to the USD at a fixed rate of MYR 3.8 = USD 1. This represents the limiting scenario described above. The figure below shows a comparison of exchange rates between September 2003 and September 2005, and the USD-EUR exchange rate is exactly the same as the MYR-EUR rate in that period.

Echange rates between the Malaysian Ringgit, Euro and US Dollar for the period between Sept 2003 to Sept 2005.

In summary, if the MYR is closely correlated to the USD, then MYR-EUR and USD-EUR exchange rates are closely correlated because there is little difference between MYR and USD.

Data analysis - MYR

The following graph shows the MYR, EUR and USD exchange rates for the past 830 days (an arbitrary choice). The exchange rates have been chosen so that the USD-EUR forms the basis of comparison. If the MYR is closely related to the USD, then the MYR-EUR rates should resemble the USD-EUR rates.

On the other hand, if the MYR is closely related to the EUR, then the USD-MYR rates should resemble the USD-EUR rates.

Click here for large size image

Exchange rates between the Malaysian Ringgit, Euro and US Dollar for the period between July 2005 to Sept 2007

In the earlier half of the period graphed, the USD-EUR and MYR-EUR rates are very similar, suggesting that the USD and MYR are still strongly correlated. Closer to the present, near the end of the graphed period, the correlation is less obvious. However, the MYR is still closer to the USD than to the EUR.

Data analysis - AUD

The following graph shows the AUD, EUR and USD exchange rates for the past 830 days (an arbitrary choice). The exchange rates have been chosen so that the USD-EUR forms the basis of comparison. If the AUD is closely related to the USD, then the AUD-EUR rates should resemble the USD-EUR rates.

On the other hand, if the AUD is closely related to the EUR, then the USD-AUD rates should resemble the USD-EUR rates.

Click here for large size image

Exchange rates between the Australian Dollar, Euro and US Dollar for the period between July 2005 to Sept 2007

From the 830 days graphed here, the AUD follows the EUR in a fairly consistent manner. Thus the AUD is much closely correlated to the EUR than to the USD.

Concluding remarks

From the analysis done above, it is shown qualitatively that the MYR is closely correlated to the USD, and that the AUD is closely correlated to the EUR. A change of the USD-EUR exchange rate will be reflected in a similar change in the MYR-AUD exchange rate.

Additional information

Exchange rates

5-year data for normalised rates used in this analysis can viewed for:

MYR, EUR, USD

AUD, EUR, USD

Labels: applied mathematics, applied science, finance

<< Home