Should you replace your car with a newer model with lower fuel consumption?

Contents

1. Introduction

2. Method of analysis

Choice of test cases

Valuation of cases

Cost function

Optimum solution

3. Sample problem

Available options

Cost functions

Solution method

Choosing a non-optimum choice

Introduction

1. Introduction

2. Method of analysis

Choice of test cases

Valuation of cases

Cost function

Optimum solution

3. Sample problem

Available options

Cost functions

Solution method

Choosing a non-optimum choice

Introduction

Advancements in automotive power plants have produced cars with ever improving fuel efficiency. In some instances, it may be a better choice to trade in an old fuel guzzler for a newer vehicle. Other times, it may not be a financially sound move. This paper will show how some variables will affect the decision making process.

Method of analysis

Method of analysis

Choice of test cases

The available set of test cases is preselected by the user to account for personal preferences. For example, a user may choose to consider buying a Honda Accord, a Nissan Cefiro, or stay with the current vehicle. While there are numerous other choices available in the market, these are may not be included in the test because the user deems these unfit for consideration, based on price and preference.

Valuation of cases

Each case is valued based on purchase price and fuel consumption. Depreciation/resale value is not considered as this is not easy to predict for people unfamiliar with the used-car market. Cost of maintenance and repairs is also not considered as reliable records are difficult to obtain.

Valuation is performed on a cost per month basis, where the costs consist of:

Fuel- dependent on expected driving distance in a month, fuel consumption of the car and cost of fuel

Opportunity cost (lost of potential investment income)- dependent on money invested in obtaining a new car (after accounting for the resale price of the current vehicle) and the expected rate of return in the capital market

Fuel- dependent on expected driving distance in a month, fuel consumption of the car and cost of fuel

Opportunity cost (lost of potential investment income)- dependent on money invested in obtaining a new car (after accounting for the resale price of the current vehicle) and the expected rate of return in the capital market

Cases are compared on basis of cost, and the case which presents the least cost is the optimum choice.

Cost function

The cost of fuel is the product of distance driven per month, the quantity of fuel used per km, and the price of fuel.

Z = dηp + c[(1+i)1/12 - 1]

Where:

Z is the total cost per month

d is the expected distance driven in a month

η is the fuel consumption per km

p is the price of fuel

c is the cost of obtaining a new car

i is the rate of return in the capital market

The term c[(1+i)1/12 - 1] indicates the returns from investing in the capital market that would be had if the money had been invested rather than being spent on the new car.

Optimum solution

The optimum solution is the choice which results in the lowest cost per mont.

Sample problem

Available options

Suppose our protagonist currently owns a Mitsubishi Pajero. He drives approximately 1500 km in a month, and a car salesperson has quoted him a resale value of $3,000 for the car. This car consumes 0.11 liters of petrol per km travelled. (Case 1)

He is considering buying a used Toyota Prius, which sells for $10,000 and has a published fuel consumption rate of 0.05 liters of petrol per km travelled. (Case 2)

Alternatively, a Honda Accord is available for $4500, and consumes 0.08 liters of petrol per km travelled. (Case 3)

The capital market rate of return, i, and the price of fuel, p, is not known.

Cost functions

Z1 = 1500×0.11p

Z2 + (10000-3000)[(1+i)1/12 - 1]

Z3 = 1500×0.08p + (4500-3000)[(1+i)1/12 - 1]

As discussed above, the cost function for each case is the cost of fuel and the lost opportunity to invest in capital markets. Case 1 does not involve opportunity cost as no additional outlays are required.

Z2 + (10000-3000)[(1+i)1/12 - 1]

Z3 = 1500×0.08p + (4500-3000)[(1+i)1/12 - 1]

As discussed above, the cost function for each case is the cost of fuel and the lost opportunity to invest in capital markets. Case 1 does not involve opportunity cost as no additional outlays are required.

Solution method

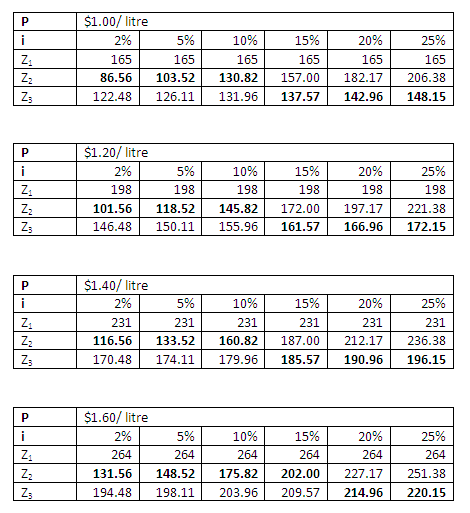

A brute force approach will be used here, as this method allows a large number of cases to be considered. It goes without saying that a spreadsheet program will be most helpful.

The cost functions for all cases are evaluated for a set of possible values of p and i.

The series of tables show the cost of making each choice for different combinations of fuel price and market rate of return. In this solution, the optimum choice (least expensive) is Case 2 if the market rate of return is expected to be low, and Case 3 if the market rate of return i is expected to be high.

Choosing a non-optimum choice

In some cases, the user may have non-monetary preferences. For example, the protagonist may have a slight dislike for the Toyota Prius because of the perception that only hippies and tree hugging Hollywood-types will want one of these cars.

As it turns out, the Toyota Prius (case 2) was found to be least costly in situations where i is low. In such situations, choosing case 3 instead of case 2 means the user will have to spend more than absolutely necessary.

How much extra are you willing to pay to choose a non-optimal choice? If p = 1.60 and i = 5%, the cost Z2 is 149 while the cost Z3 is 198. Are you willing to pay an extra $49 per month just to escape the tree-hugging image of a Toyota Prius?

Labels: applied mathematics, how-to

<< Home